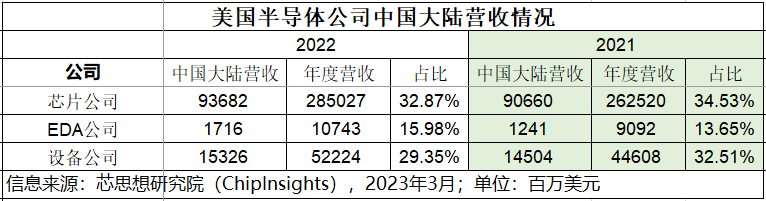

According to the Semiconductor Industry Association of the United States, global semiconductor industry sales in 2022 reached 574.1 billion dollars, up 3.3 percent from 555.9 billion dollars in 2021. Although the total value of 2022 sales decreased by 6.3% compared with 2021, the Chinese mainland remained the world's largest single market for semiconductors, with total value of $180.3 billion in 2022, accounting for about 32.5%. American semiconductor companies account for about 45% of global sales. ChipInsights has combed through the revenue of 19 major semiconductor companies in the U.S. (13 chip companies, three EDA companies, and three device companies), and here's what it looks like.

The 13 major U.S. chip companies collectively reported $285 billion in revenue in 2022, up $22.5 billion, or 8.57%, from $262.5 billion in 2021. Of the 13 major chip companies, only Intel reported negative revenue growth, while all the other 12 reported revenue growth, with ADI up 64 percent, AMD up 43 percent and Marvell up 33 percent.

Starting in 2019, U.S. semiconductor companies have changed the rules of regional revenue statistics. Before 2019, products delivered to mainland China were counted as revenue in mainland China. Now, the calculation is based on the headquarters of distributors, Oems, contract manufacturers, channel partners or software customers. An Apple order, for example, was delivered in mainland China, counted as revenue from mainland China, and now counted as revenue from the United States.

According to ChipInsights, the 13 leading US chip companies each derive more than 10 per cent of their revenues from the Chinese mainland; Their combined revenue from mainland China reached $93.7 billion, up $3 billion, or just 3.3%, from 2021; Thirteen companies collectively generated more than 32.87 percent of their revenue from the Chinese mainland, down from 34.53 percent in 2021. Qualcomm derives more than 50 per cent of its revenue from mainland China, at 63.62 per cent; Texas Instruments derives 49 per cent of its revenues from mainland China; Marvell accounted for 42% of revenue from China; Broadcom gets 35 percent of its revenue from mainland China; Others are below the combined percentage, the lowest being Skyworks at 11%.

Of the 13 major US chip companies, seven reported year-on-year revenue growth from mainland China, while six reported negative growth. ADI's revenue from the Chinese mainland was $2.5 billion, up 59% year on year; AMD's revenue from mainland China was $5.2 billion, up 27% from a year earlier. Qualcomm's revenue from mainland China was $28.1 billion, up 25 percent from a year earlier and doubling from $14 billion in 2020.

Of the 13 major chip companies in the United States, Qualcomm has the largest revenue from mainland China, at $28.1 billion; Intel (INTC) at $17.1 billion, down 25% year on year; Third is Broadcom, up 19 per cent year on year.

Many of the 13 major U.S. chip companies said in their earnings statements that a strong position in China is a key part of their global growth strategies. But as trade relations between China and the United States deteriorate, it is impossible to predict whether the uncertainty will continue to worsen in the coming period.

In 2022, the combined revenue of the three EDA giants in the United States reached 10.7 billion US dollars, of which the revenue from the Chinese mainland exceeded 1.7 billion US dollars, an increase of about 500 million US dollars compared with 2021. Revenue accounted for 16%, up about 2.3 percentage points from 2021.

In 2022, the combined revenue of the three U.S. equipment giants reached $52.2 billion, of which $15.3 billion came from the Chinese mainland, an increase of about $800 million compared with 2021. Revenue at 29%, down about 3 percentage points from 2021.

In fact, the results of the U.S. -China trade war and the embargo against a domestic company showed little impact on U.S. semiconductor companies' revenue in 2022. But from the recent layoffs of various companies, it is not optimistic.

ChipInsights notes that global semiconductor companies are actively looking to increase their market share in China due to its huge market capacity. American companies are also actively promoting localization in China in a number of ways. In March 20203, the legal entity of NI China, Shanghai Enai Instrument Co., Ltd. was officially renamed and upgraded to "Enai (China) Instrument Co., LTD." to speed up the localization development process. Another example is that in December 2020, ADI announced to increase its investment in the Chinese market, upgrading Adeno Semiconductor Technology (Shanghai) Co., Ltd. to Adeno Semiconductor (China) Co., LTD., and taking it as the headquarters organization of ADI's investment and operation in China, with more decision-making ability. In addition, the company will have full capabilities in demand research, product definition, research and development, marketing and operation to determine the direction of investment in products and technologies, and quickly respond to the innovation needs of the Chinese market. More American companies are setting up new joint ventures in mainland China, which are dominated by domestic capital and owned independently, while inheriting foreign technology.