Reprinted from Semiconductor Industry Watch, thank you.

Recently, according to the statistics of the General Administration of Customs, although IC is still the largest import commodity

of the Chinese mainland ahead of crude oil, the quantity and value of China's IC imports will decline significantly in 2023.

The data showed that China imported 479.6 billion integrated circuits worth $349.4 billion in 2023, down 10.8 percent from 2022,

and the import value dropped 15.4 percent.

It is also the first time since the General Administration of Customs began tracking the data in 2005 that it has declined for two

consecutive years.

In this regard, the author traced the import and export statistics records of the General Administration of Customs since 2005, to

have a look at the import and export situation and changing trend of IC industry in our country, as well as the industry development

context reflected therein.

China's IC industry, running wild

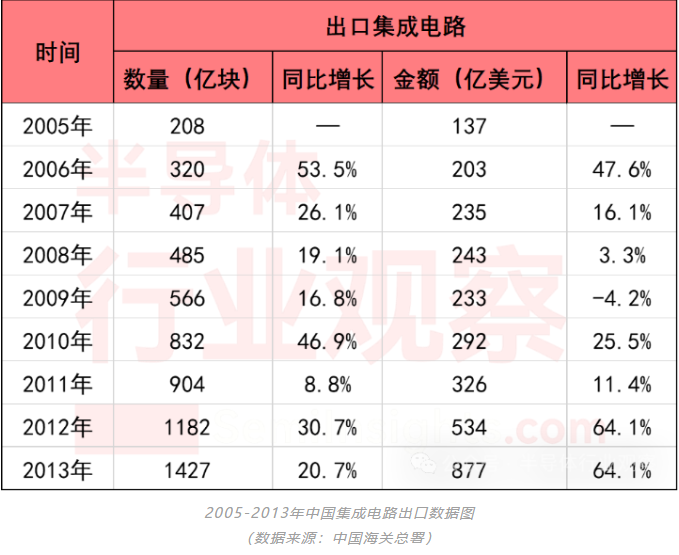

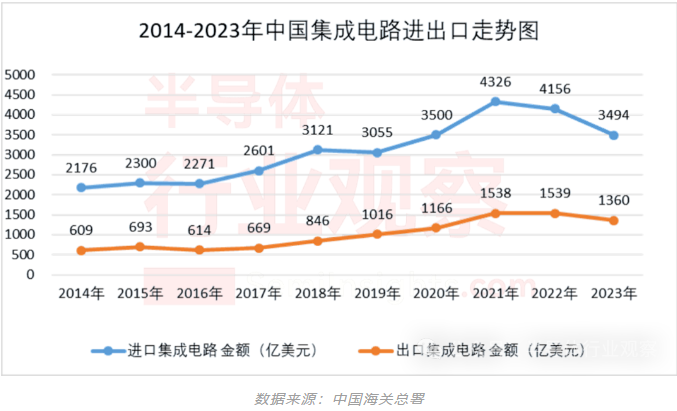

It can be seen that the import and export volume of IC in China has shown a trend of rapid growth since the statistics began,

with occasional fluctuations in the middle years.

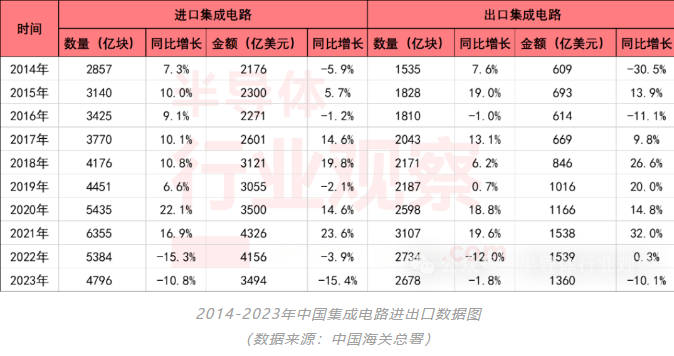

According to customs data, China imported 285.7 billion pieces of IC in 2014, up 7.3% year on year; Imports amounted to US

$217.6 billion, down 5.9% year on year. 153.5 billion pieces of IC were exported, up 7.6% year on year; The export value was

US $60.9 billion, down 30.5% year on year.

By 2021, China's import and export volume of IC both hit a record high. According to data statistics, in 2021, China imported

635.5 billion pieces of IC, up 16.9% year on year; The value of imports reached 432.6 billion US dollars, up 23.6% year on year.

China exported 310.7 billion pieces of IC, up 19.6% year on year; The export value reached 153.8 billion US dollars, up 32% year

on year.

It can be clearly seen from the comparison that both the quantity and amount of IC import and export have doubled in 2021

compared with 2014, which means that China's IC industry has experienced a period of rapid development.

The development of integrated circuit industry is naturally driven by the demand of the end market. From 2014 to 2018, smartphones

were in a period of rapid penetration, and the global semiconductor market was booming, driven by the strong demand for

downstream smartphones, TWS and other consumer electronics.

During this period, not only the import and export data of IC have both improved, but also the output value of China's IC has been climbing

to a new height.

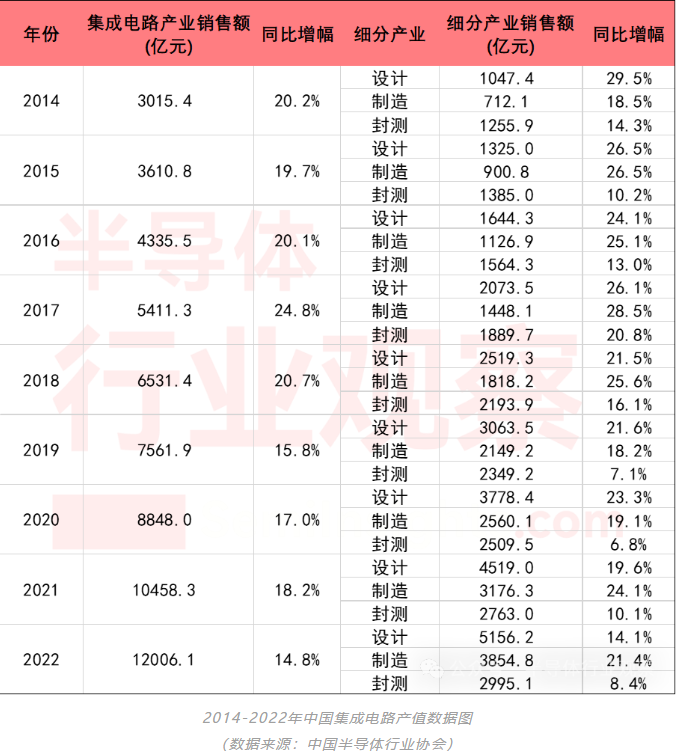

According to the statistics of China Semiconductor Industry Association, the sales volume of China's IC industry in 2014 was RMB301.54 billion,

representing year-on-year increase of 20.2%. Among them, the design industry grew the fastest, with sales of 104.74 billion yuan, up 29.5% year

on year; Influenced by production of Xi 'an Samsung, the growth rate of manufacturing industry reached 18.5% in 2014, and the sales volume reached 71.21

billion yuan; Sales of the sealing and testing industry reached 125.59 billion yuan, up 14.3% year on year.

By 2018, the sales volume of China's IC industry more than doubled that of 2014, and in 2021, the sales volume of China's IC industry more than tripled that of

2014.

The trade deficit in import and export of integrated circuits continued to increase.

This means that the self-sufficiency rate of China's integrated circuit industry is low, and domestic chips are still not enough to meet the domestic semiconductor

demand, especially in the field of high-end chips, the phenomenon of dependence on imports is more serious.

But it is worth noting that in 2022, China's IC trade deficit began to shrink accordingly.

The data and changes in the import of IC in our country have been introduced above. In terms of exports, China's IC exports fell 12 percent year-on-year to 273.4 billion

units in 2022. However, the value of exports rose slightly by 0.3% to $153.9 billion during the same period, leaving a deficit of $261.7 billion, down 6.1% from a year

earlier.

In 2023, the number of China's IC exports further dropped to 267.8 billion, the export value dropped significantly by 10.1% to 136 billion US dollars, and the trade deficit

narrowed to 213.4 billion US dollars, down 18% year on year.

As for the shrinking trade deficit, on the one hand, countries around the world are competing for production capacity, attracting semiconductor companies through a large

number of subsidies and preferences, aiming to meet local demand more and reduce imports, which also reduces China's export volume of integrated circuits to a certain

extent;

On the other hand, the reduction degree of import is greater than that of export, which indicates that the self-sufficiency rate of chip in our country is further improving.

According to foreign media forecasts, China's chip self-sufficiency rate will reach 23.3% in 2023 (including products produced by foreign companies in China).

This figure is an improvement from the 16.6 percent chip self-sufficiency rate in 2020, and China has taken a solid step towards the goal of increasing chip self-sufficiency

despite some import dependence.

Especially as the global semiconductor industry experiences a downturn in 2022 and 2023, the output of domestic chips is still growing. According to statistics, the sales scale

of China's IC industry in 2022 will be about 1.2 trillion yuan, an increase of 14.8% over the previous year; From January to October 2023, China's cumulative production of

integrated circuits reached 276.53 billion units, still up 0.9 percent compared with last year. The resilience and development space of China's IC market can be seen.

From the perspective of industry development trends and situation over the years, China's IC industry has a good momentum of development, and is expected to further

improve its independent innovation capacity and occupy a larger share in the global chip market in the future.

The global semiconductor Market is expected to grow significantly over the next 10 years, according to market research firm Market.us. Global sales are expected to grow

at a compound annual growth rate (CAGR) of 8.8% from 2023 to 2032, and the global semiconductor market size is expected to reach USD 1,307.7 billion by 2032.

Strengthening collaborative innovation in the domestic semiconductor industry chain: The semiconductor industry is a highly complex and specialized industry chain, which

requires closecooperation and coordination between the upstream and downstream links. At present, there are still some weak links in China's semiconductor industry chain. It is suggested to

the communication and technical cooperation between all links of the domestic industry chain, form an effective innovation mechanism and incentive mechanism, and improve the

competitiveness and innovation of the whole industry chain.

Expand the space for cooperation in the international semiconductor market: In the current global trade environment, unilateral reliance on imports of high-end chips is not sustainable

and is not conducive to the healthy development of the domestic semiconductor industry.

It is suggested to expand the cooperation space in the international semiconductor market, establish more stable

and mutually beneficial cooperative relations with countries and regions around the world, and ensure the supply security and stability of the IC market.

Accelerate the promotion and popularization of emerging technologies/applications: Emerging technologies and applications are the main growth points and driving forces of the IC market,

as well.as important opportunities and challenges for the domestic semiconductor industry. It is recommended to accelerate the promotion and popularization of emerging technologies and applications,

improve the demand and quality of high-end chips in the domestic market, and promote the innovation and development of the domestic semiconductor industry

Cultivating talent teams in the domestic semiconductor industry: Talent is the core resource of the semiconductor industry and a key factor in China's chip market. At present, China's semiconductor

industry is still facing the problem of talent shortage and loss. It is suggested to cultivate the talent team of the domestic semiconductor industry, strengthen the education and training of semiconductor

related majors, attract and retain excellent talents, and improve the talent level and competitiveness of the domestic semiconductor industry.

In short, in the future development process, China's IC market will still face a series of challenges and opportunities, which need to be analyzed and predicted from various aspects, and corresponding

measures and strategies should be taken to provide support for the innovation and development of the domestic semiconductor industry.